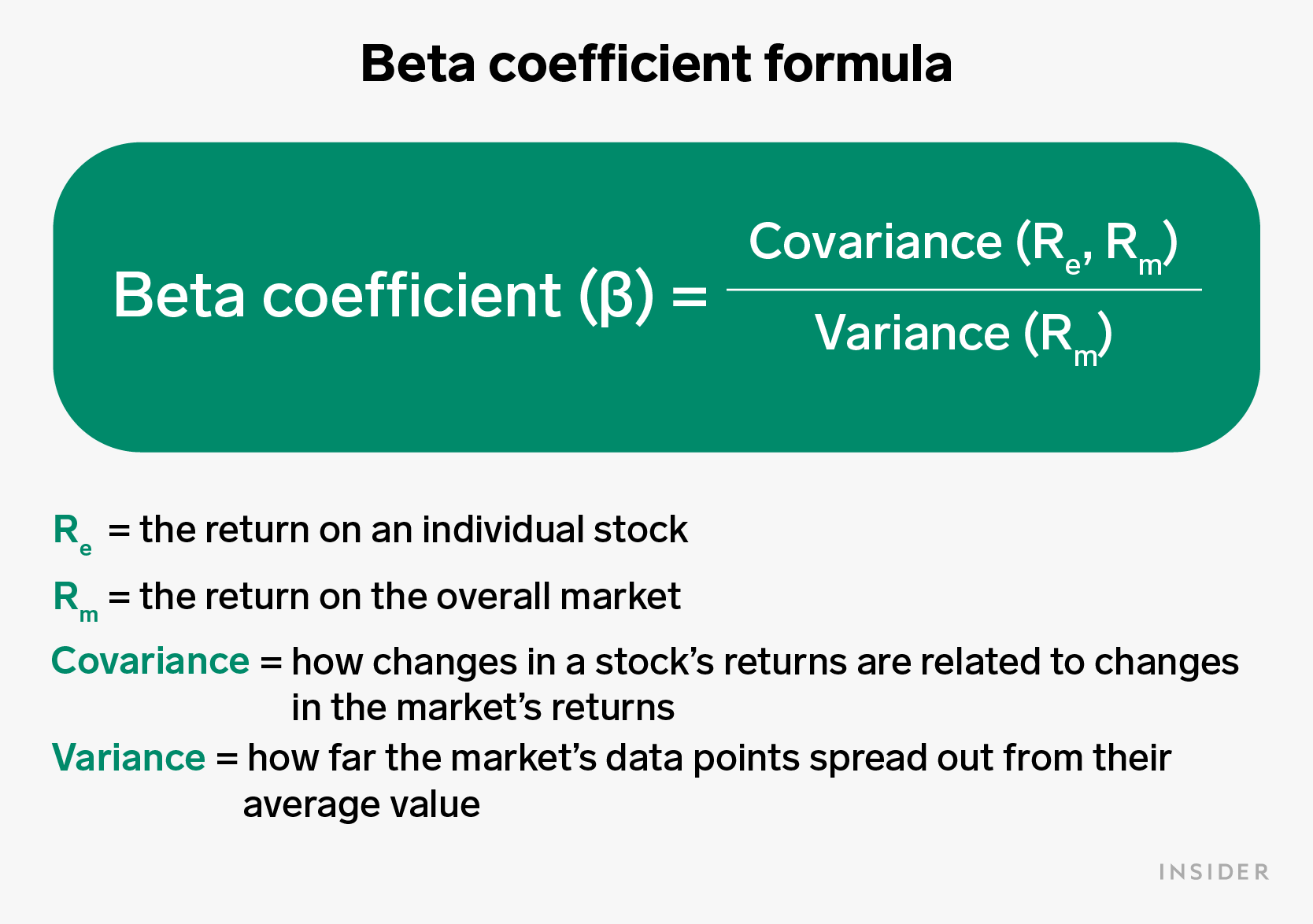

Market Beta Historical Data . It is used as a measure of. Beta looks at the correlation in. first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. beta is a measure of a particular stock's relative risk to the broader stock market. A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. the beta (β) of an investment security (i.e., a stock) is a measurement of its volatility of returns relative to the entire market. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. betas by sector (us) data used: Data used is as of january 2024. how beta works.

from www.businessinsider.nl

first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. It is used as a measure of. Data used is as of january 2024. beta is a measure of a particular stock's relative risk to the broader stock market. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. Beta looks at the correlation in. how beta works. A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. the beta (β) of an investment security (i.e., a stock) is a measurement of its volatility of returns relative to the entire market. betas by sector (us) data used:

Beta can help you determine how much your portfolio will swing when the

Market Beta Historical Data A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. betas by sector (us) data used: first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. Data used is as of january 2024. the beta (β) of an investment security (i.e., a stock) is a measurement of its volatility of returns relative to the entire market. beta is a measure of a particular stock's relative risk to the broader stock market. It is used as a measure of. A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. Beta looks at the correlation in. how beta works.

From wealthdesk.in

Difference Between Alpha and Beta in Stock Market WealthDesk Market Beta Historical Data Data used is as of january 2024. beta is a measure of a particular stock's relative risk to the broader stock market. A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. how beta works. It is used as a measure of. first, beta is calculated using historical. Market Beta Historical Data.

From www.researchgate.net

Betas Calculation Methods A Comparison The Table provides the summary Market Beta Historical Data betas by sector (us) data used: Beta looks at the correlation in. Data used is as of january 2024. A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements. Market Beta Historical Data.

From www.valuethemarkets.com

What is Beta in the Stock Market? Beta in Investing Explained Market Beta Historical Data Data used is as of january 2024. It is used as a measure of. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. betas by. Market Beta Historical Data.

From www.brrcc.org

Historical Stock Market Returns By Year Chart May 2020 Market Beta Historical Data Beta looks at the correlation in. first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. betas by sector (us) data used: It is used as a measure of. Data used is as of january 2024. the value of beta is calculated using historical share. Market Beta Historical Data.

From tradingtuitions.com

Stock Beta Calculation in a Spreadsheet Step by Step Tutorial Market Beta Historical Data first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. how beta works. beta is a measure of a particular stock's relative risk to the broader stock market. Data used is as of january 2024. Beta looks at the correlation in. the beta (β). Market Beta Historical Data.

From www.slideserve.com

PPT Weighted average cost of capital PowerPoint Presentation, free Market Beta Historical Data It is used as a measure of. betas by sector (us) data used: the beta (β) of an investment security (i.e., a stock) is a measurement of its volatility of returns relative to the entire market. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. A beta. Market Beta Historical Data.

From abwinsights.com

Smart Beta and Market Timing AlphaBetaWorks Insights Market Beta Historical Data A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. Data used is as of january 2024. the beta (β) of an investment security (i.e., a stock) is a measurement of its volatility of returns relative to the entire market. how beta works. betas by sector (us) data. Market Beta Historical Data.

From www.investopedia.com

What Beta Means for Investors Market Beta Historical Data first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. how beta works. betas by sector (us) data used: It is used as a measure. Market Beta Historical Data.

From haipernews.com

How To Calculate Beta Formula Haiper Market Beta Historical Data It is used as a measure of. Data used is as of january 2024. first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. betas by sector (us) data used: how beta works. the beta (β) of an investment security (i.e., a stock) is. Market Beta Historical Data.

From www.researchgate.net

Dynamics of world market beta. Source Figure realised by authors Market Beta Historical Data first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. how beta works. Beta looks at the correlation in. Data used is as of january 2024. . Market Beta Historical Data.

From winbuzzer.com

Microsoft Excel STOCKHISTORY Beta Provides Data Overview of Stock Market Beta Historical Data A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. It is used as a measure of. beta is a measure of a particular stock's relative risk to the broader stock market. Beta looks at the correlation in. Data used is as of january 2024. first, beta is calculated. Market Beta Historical Data.

From abwinsights.com

Smart Beta and Market Timing AlphaBetaWorks Insights Market Beta Historical Data how beta works. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. beta is a measure of a particular stock's relative risk to the broader stock market. . Market Beta Historical Data.

From abwinsights.com

What Fraction of Smart Beta is Dumb Beta? AlphaBetaWorks Insights Market Beta Historical Data It is used as a measure of. how beta works. Data used is as of january 2024. beta is a measure of a particular stock's relative risk to the broader stock market. Beta looks at the correlation in. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity.. Market Beta Historical Data.

From abwinsights.com

Smart Beta and Market Timing AlphaBetaWorks Insights Market Beta Historical Data first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. beta is a measure of a particular stock's relative risk to the broader stock market. A. Market Beta Historical Data.

From www.statology.org

How to Plot a Beta Distribution in R (With Examples) Market Beta Historical Data betas by sector (us) data used: It is used as a measure of. Beta looks at the correlation in. how beta works. first, beta is calculated using historical market data so it’s less useful for investors who want to predict future movements in prices. the value of beta is calculated using historical share price and market. Market Beta Historical Data.

From www.scribd.com

Historical Beta Measurement Beta (Finance) Capital Asset Pricing Model Market Beta Historical Data Beta looks at the correlation in. betas by sector (us) data used: A beta coefficient shows the volatility of an individual stock compared to the systematic risk of the entire market. the beta (β) of an investment security (i.e., a stock) is a measurement of its volatility of returns relative to the entire market. how beta works.. Market Beta Historical Data.

From tradeoptionswithme.com

What Is Beta Weighting & Why You Should Use It Trade Options With Me Market Beta Historical Data how beta works. betas by sector (us) data used: Beta looks at the correlation in. beta is a measure of a particular stock's relative risk to the broader stock market. Data used is as of january 2024. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity.. Market Beta Historical Data.

From irudivupic.web.fc2.com

Dell in stock market what is beta definition and with it swap free Market Beta Historical Data Beta looks at the correlation in. the value of beta is calculated using historical share price and market index data, which indicates the past sensitivity. It is used as a measure of. beta is a measure of a particular stock's relative risk to the broader stock market. A beta coefficient shows the volatility of an individual stock compared. Market Beta Historical Data.